What is the current update on the Palm Oil prices?

Ongoing pandemic has put life into disarray. Businesses have suffered. Challenges of running an operation has increased multifold. It seems this was not enough. Now we are witnessing a huge spike in oleo chemical feed stock prices. The industry is not new to such fluctuation but for last 2-3 years’ market has remained more of speculative than fundamental driven.

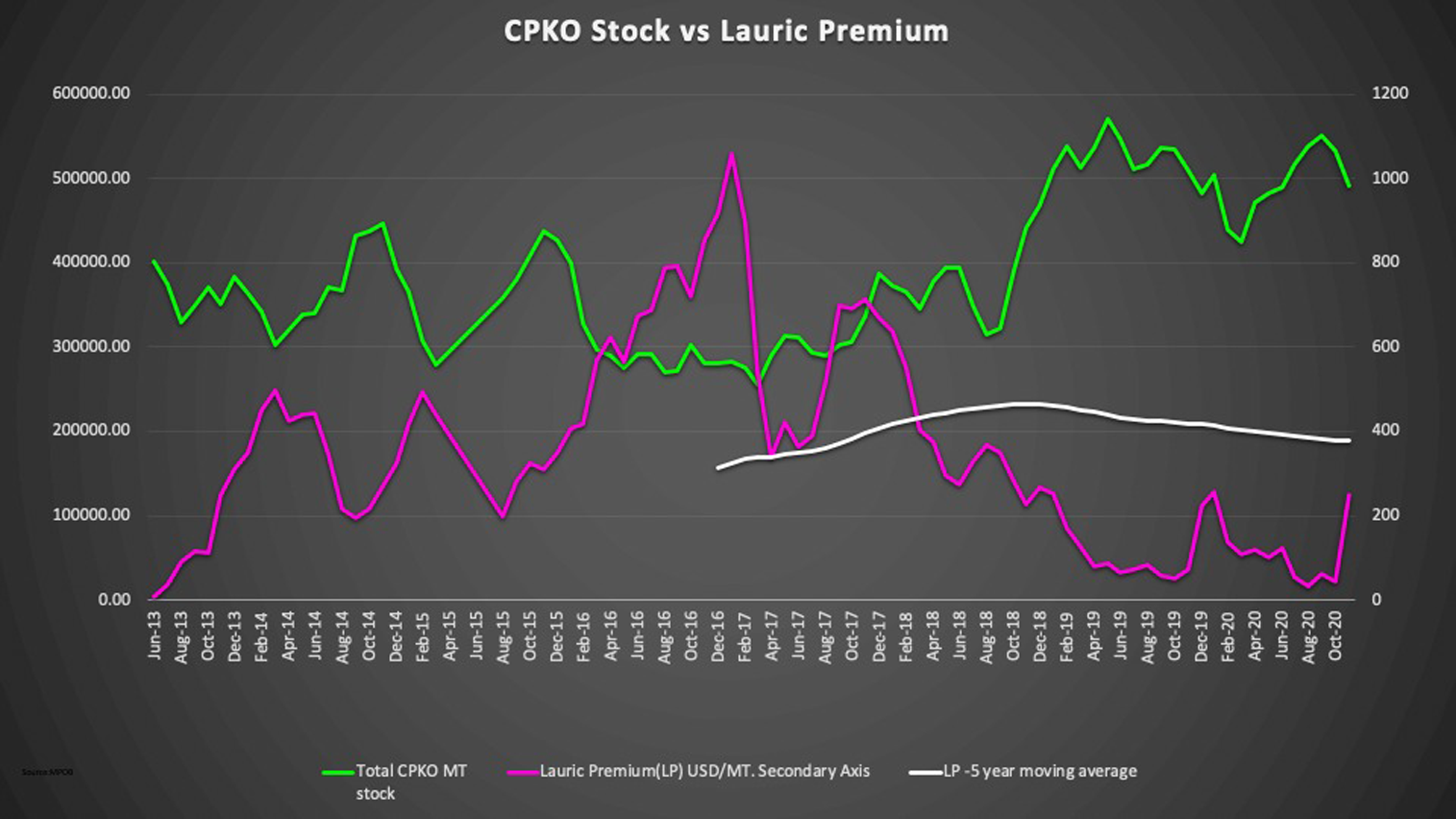

The recent spike in Crude Palm Oil(CPO) & Crude Palm Kernel Oil (CPKO) was attributed to lower production on account of dry weather & low fertilizer feed of 2019, labor issues due to pandemic, onset of La Nina, firmness in other vegetable oils etc. Graph no 1 compares CPKO stocks (CPKO stock + Oil in Palm Kernel stock) with Lauric Premium (LP, Delta between CPKO & CPO prices) in Malaysia. Usually Lauric Premium (Orange Line) is inversely proportional to CPKO stocks (Blue Line). Recent trend has been an aberration to this equation. Though CPKO stocks are multiyear high, CPKO & LP have gained significantly. One of the possible clue can be 5 year moving average LP trend. Current LP is trading lower than this average & so in my opinion, it has room to rise more.

Graph No 1

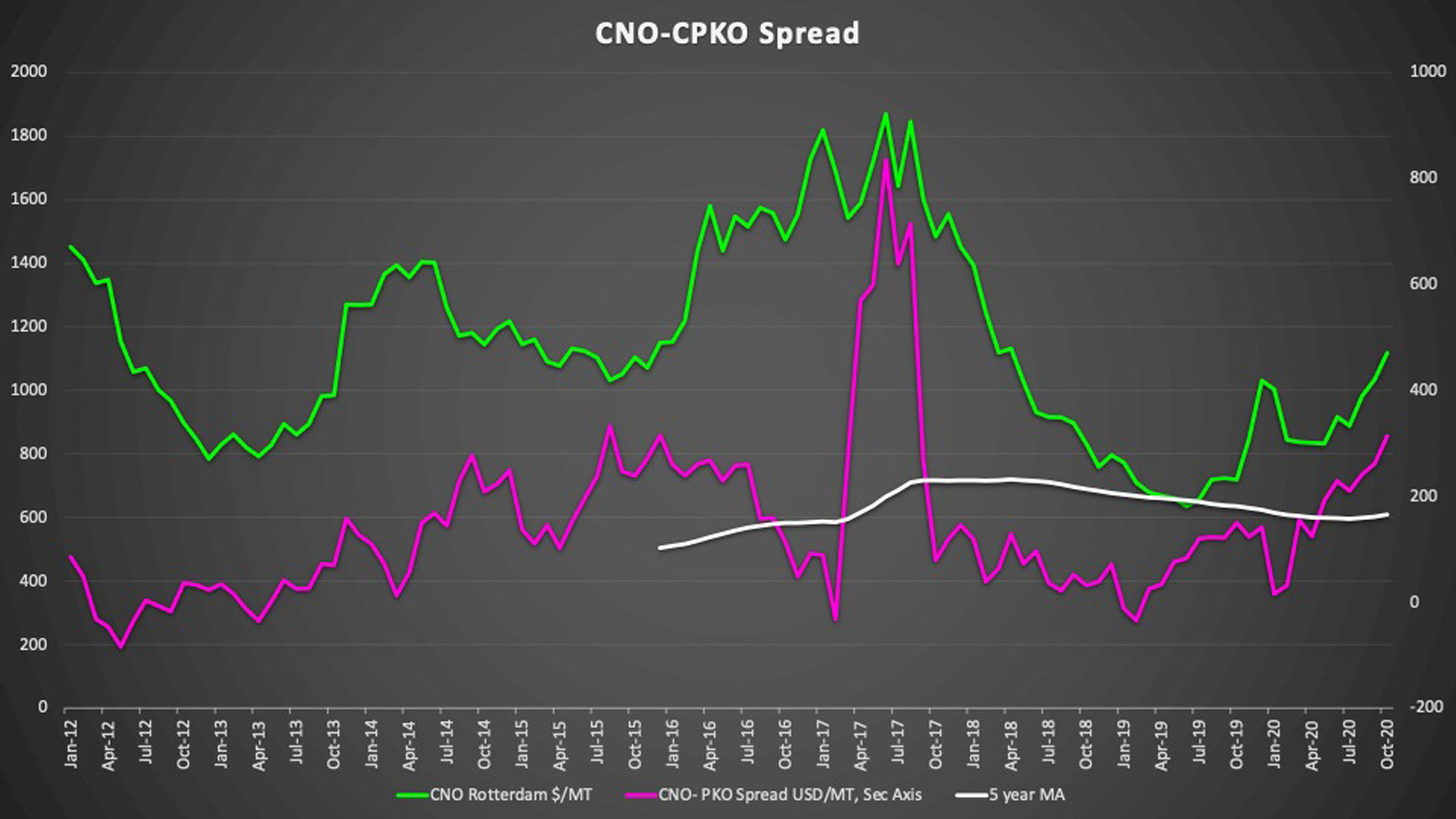

Comparison of Crude Palm Kernel Oil(CPKO) & Crude Coconut Oil(CNO) tells different story. Graph no 2 plots CNO-CPKO spread with 5-year MA. The current spread is much higher than 5-year average & probability of rationalization looks high.

Graph No 2

At current price level of Oleo derivatives, the other probable substitute feedstock from Petchem source will be attractive. It will encourage shift towards Petchem derived feedstock & help capping the rise of Oleo-chemicals.

Lauric Oils in Long Run:

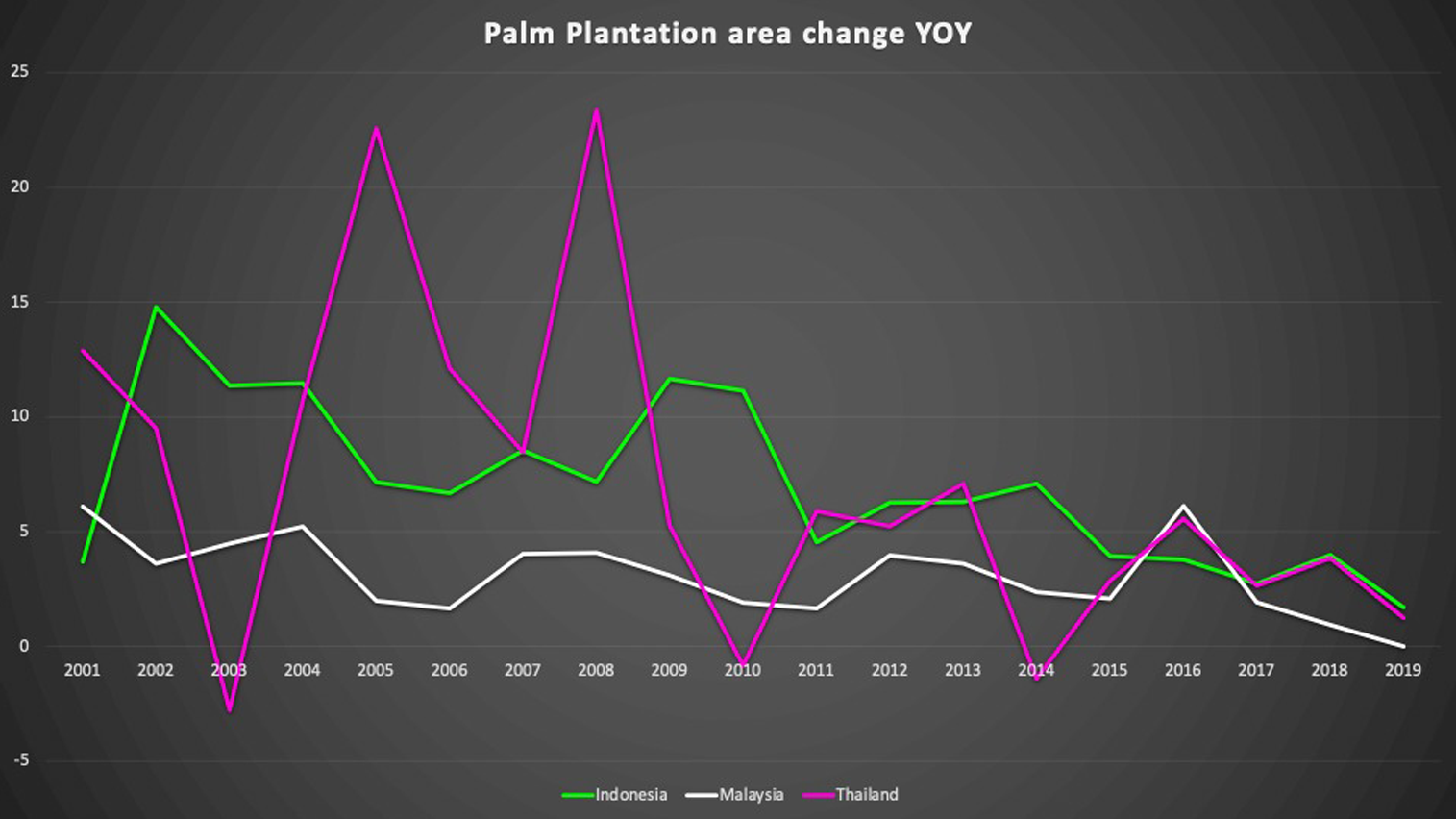

Now let us look at the long term profiling of the Oil Palm industry. Graph No 3 gives an indication of Y-O-Y change in the Palm Plantation Area for Indonesia, Malaysia & Thailand

Graph No 3

In last 5 years, there has been hardly any increase in the plantation area. The constant approach towards environmental friendly business methods has made these governments to halt any further license for expansion.

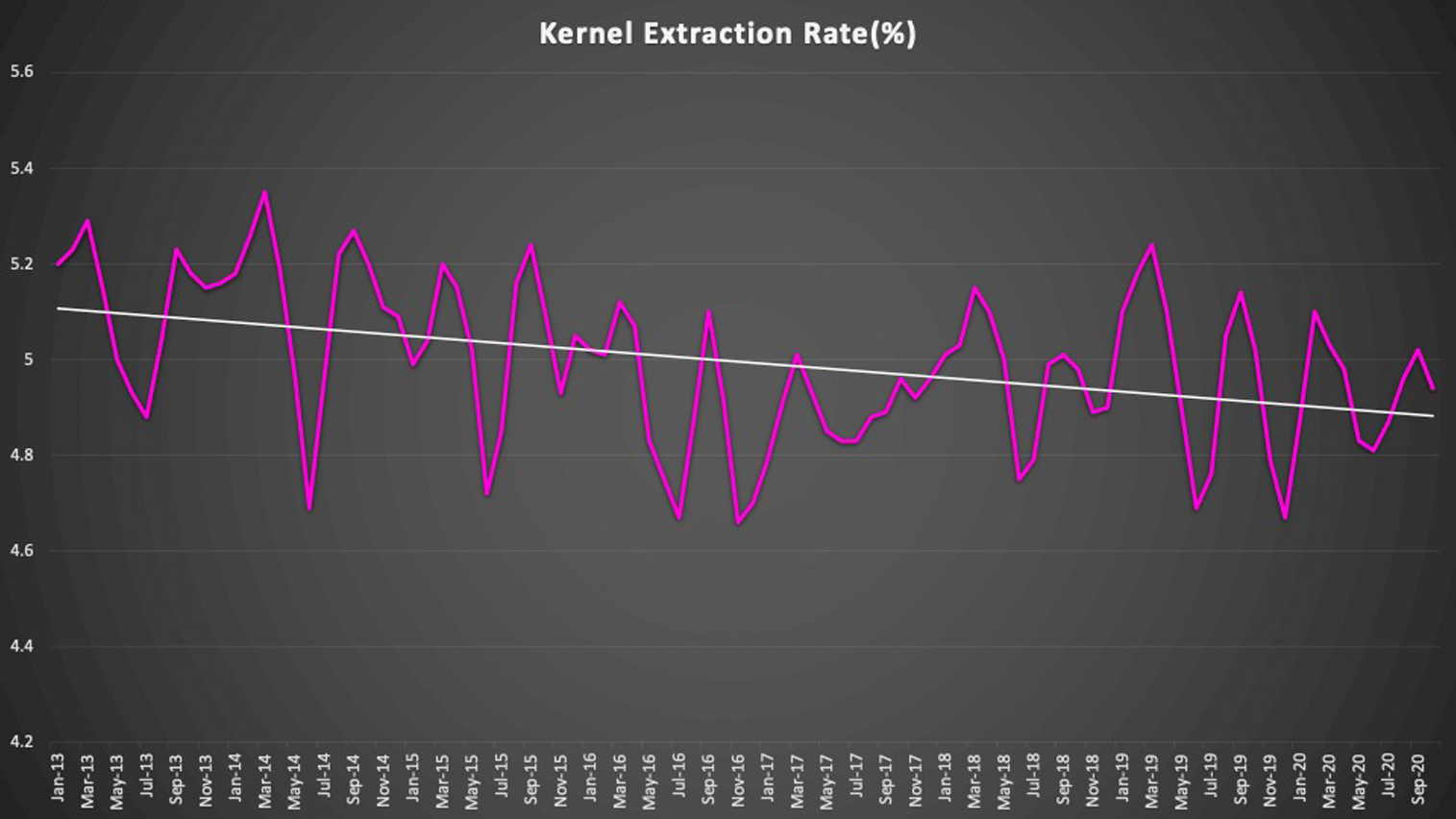

Let us analyze Palm Kernel Extraction Rate (KER). KER is the % of kernel in Fresh Fruit Branch(FFB) by mass. Graph no 4 represents last 7 years KER data.

Graph No 4

As the trend suggests, KER has been gradually falling over the years. For plantation players, Palm oil has been the major source of income while Palm Kernel Oil is a like a by-product of the process. In last 2 decades, major efforts have been put to improve yields of Palm Oil which is probably compensated by Palm Kernel.

Above observation is further supported by the graph no 5. Coconut oil production (Refer Blue Line) is stagnant for last 20 years. PKO production is improving but YOY rate is slowing down as indicated by the trend line

Graph No 5

Above graphs (3,4 & 5) imply that the future availability of Lauric Oils i.e. CPKO & CNO will be constrained. Demand for these oils in Food & Oleo chemical industry will continue to grow. The future is therefore, expected to be bullish for these Lauric Oils in the long run.